Some Known Factual Statements About Liquidation Melbourne

Table of ContentsLiquidation Melbourne Can Be Fun For EveryoneSome Known Incorrect Statements About Insolvency Melbourne The Ultimate Guide To Insolvency MelbourneAll about Bankruptcy Advice MelbourneA Biased View of Bankruptcy Australia

As Kibler said, a company requires to have a truly great reason to reorganize an excellent factor to exist and the increase of e-commerce has made stores with large shop existences out-of-date. Second chances may be a precious American suitable, yet so is advancement as well as the growing pains that come with it.Fresh Start Solutions Melbourne

Address: 9/440 Collins St, Melbourne VIC 3000, Australia

Phone: +61 1300 818 575

Are you looking down the barrel of declaring on your own insolvent in Australia? This is no reason for a person leading you down the course of proclaiming bankruptcy.

We comprehend that everybody deals with economic stress at some time in their lives. In Australia, also households and also companies that appear to be prospering can experience unanticipated difficulty due to life modifications, work loss, or elements that run out our control. That's why, right here at Leave Financial Debt Today, we provide you skilled guidance as well as assessments concerning the true consequences of personal bankruptcy, financial obligation contracts and also other monetary concerns - we desire you to return on your feet and also stay there with the ideal possible outcome for your future and also all that you desire to attain.

Rumored Buzz on File For Bankruptcy

It is worth keeping in mind that when it comes to financial obligation in Australia you are not alone. Personal personal bankruptcies and also bankruptcies go to a document high in Australia, influencing three times as several Australian compared to twenty years back. There is, nonetheless, no safety and security in numbers when it involves declaring personal bankruptcy and insolvency.

One point that several Australian people are uninformed of is that in actual fact you will certainly be detailed on the Australian NPII for just lodging an application for a financial debt agreement - Bankrupt Melbourne. Lodging a financial debt arrangement is in fact an act of declaring yourself insolvent. This is an official act of bankruptcy in the eyes of Australian regulation even if your financial obligation collection agencies do decline it.

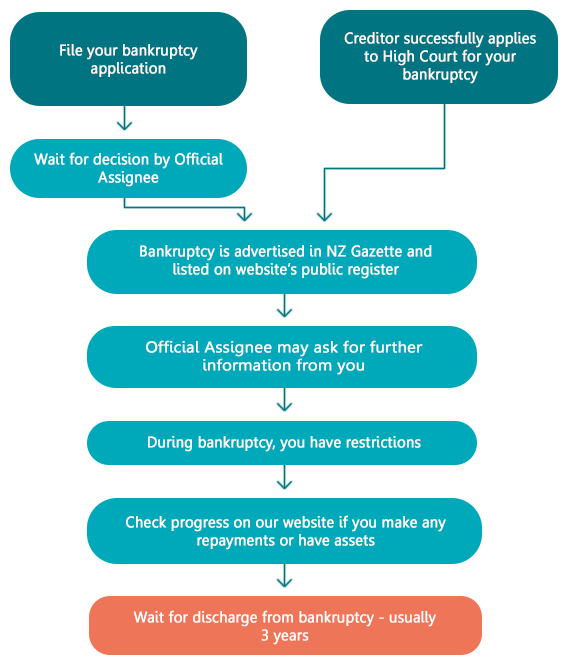

During and after your bankruptcy in Australia, you have particular obligations and encounter particular constraints. Any financial institutions who are wishing to get a copy of your credit rating record can request this details from a credit rating reporting agency. Once you are declared insolvent secured creditors, that hold safety over your building, will likely be entitled to confiscate the property as well as sell it.

An Unbiased View of Bankruptcy Australia

a home or vehicle) As soon as declared bankrupt you should inform the trustee instantly if you come to be the beneficiary of a departed estate If any one of your financial institutions hold legitimate protection over any property and they do something about it to recuperate it, you need to help You have to surrender your key to the trustee if you are asked to do so You will certainly remain liable for debts incurred after the date of your personal bankruptcy You will will not be able to work as a director or supervisor of a company without the courts approval As you can see entering right into personal bankruptcy can have long long-term negative effects on your life.

Entering into personal bankruptcy can leave your life in tatters, losing your house and also belongings as well as leaving you with absolutely nothing. Prevent this result by speaking with a financial obligation counsellor today concerning taking a different rout. Personal bankruptcy needs to blog be effectively thought around as well as prepared, you need to not ever go into insolvency on a whim as it can take on you that you might not also understand. Bankruptcy Victoria.

We provide you the capacity to pay your debt off at a decreased rate and also with minimized interest. We know what lenders are trying to find and are able to work out with them to offer you the best opportunity to repay your financial debts.

The Buzz on File For Bankruptcy

What is the distinction between default as well as personal bankruptcy? Back-pedaling a loan implies that you have actually gone against the promissory or cardholder agreement with the loan provider to make repayments in a timely manner. Each lending institution has its very own demands surrounding exactly how many missed payments you can have before it considers you in default. In many cases, that might be just one missed repayment or it can be as numerous as 9 missed payments.

How Bankruptcy can Save You Time, Stress, and Money.

For circumstances, if you back-pedal a car finance, the loan provider will certainly frequently attempt to repossess the automobile. Unsecured financial debt, like bank card debt, has no security; in these situations, it's harder for a debt collection agency to recover the financial obligation, yet the firm might still take you to court and effort to place a lien on your house or garnish your wages.

The court will certainly designate a trustee who may sell off or market a few of your properties to pay your creditors. While many of your debt will certainly be canceled, you could choose to pay some financial institutions in order to maintain an automobile or house on which the financial institution has a lien, states Ross (Personal Insolvency).

If you operate in an industry where employers inspect your credit score as part of the working with process, it may be more difficult to get a new work or be advertised after personal bankruptcy. Jay Fleischman of Cash Wise Regulation says that if you have credit report cards, they will certainly generally be shut as quickly as you apply for personal bankruptcy.